Your financial future the air force nh pay scale made clear – Your Financial Future: Air Force NH Pay Scale Made Clear. Securing your financial well-being is crucial, especially when embarking on a career in the Air Force. This comprehensive guide demystifies the Air Force’s pay structure, offering insights into base pay, allowances, bonuses, and the impact of rank and experience. We’ll explore effective financial planning strategies tailored to the unique challenges and opportunities faced by Air Force personnel, including budgeting, investment options, and retirement planning.

From understanding the intricacies of the Thrift Savings Plan to navigating potential debt management hurdles, we provide practical advice and resources to help you build a secure financial future. We’ll also examine various career paths within the Air Force and their corresponding financial implications, illustrating how strategic career choices can significantly impact your long-term financial success. Real-world examples of Air Force members who have achieved financial stability will illuminate the path to a prosperous future.

Air Force Pay and Benefits

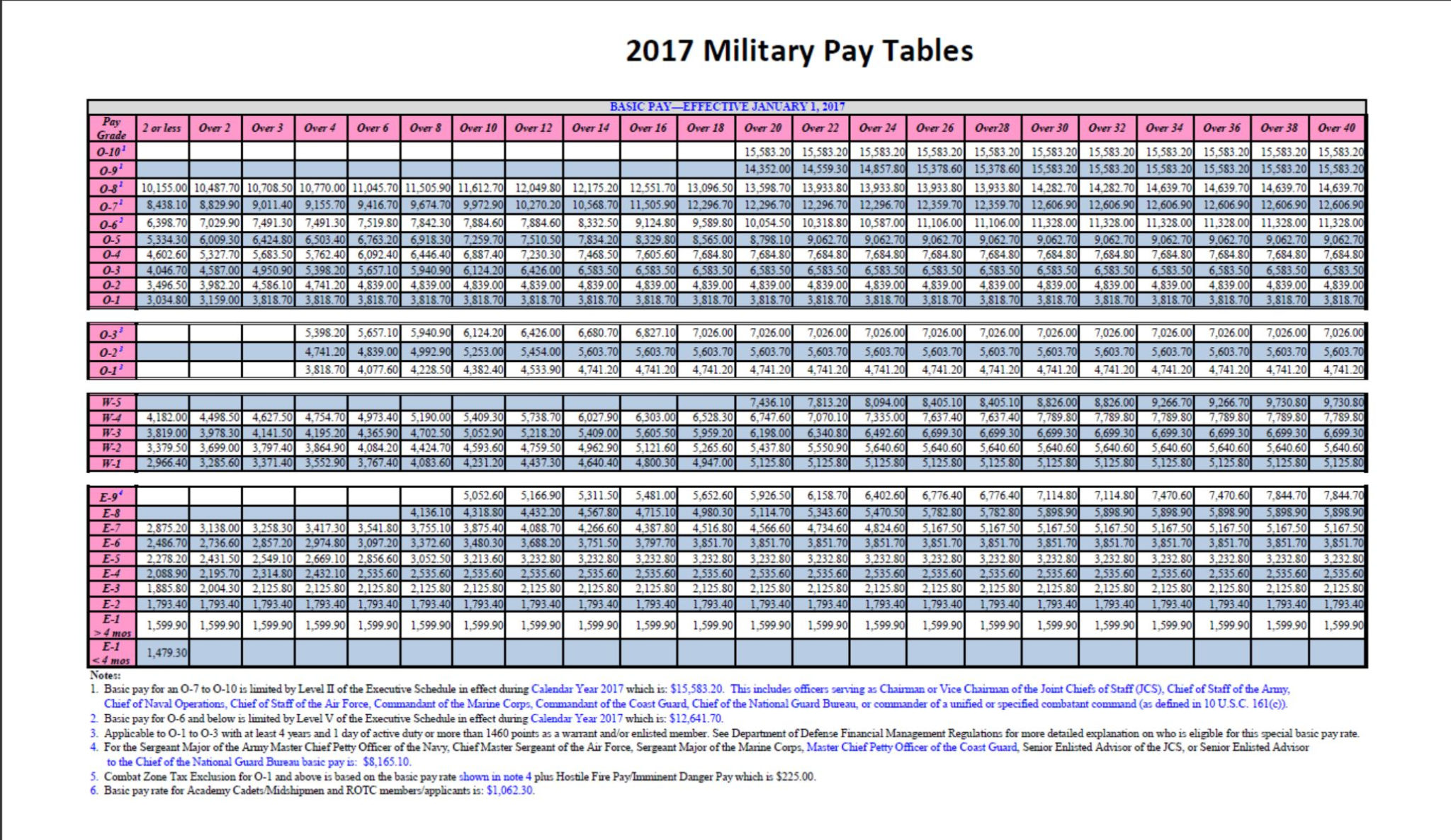

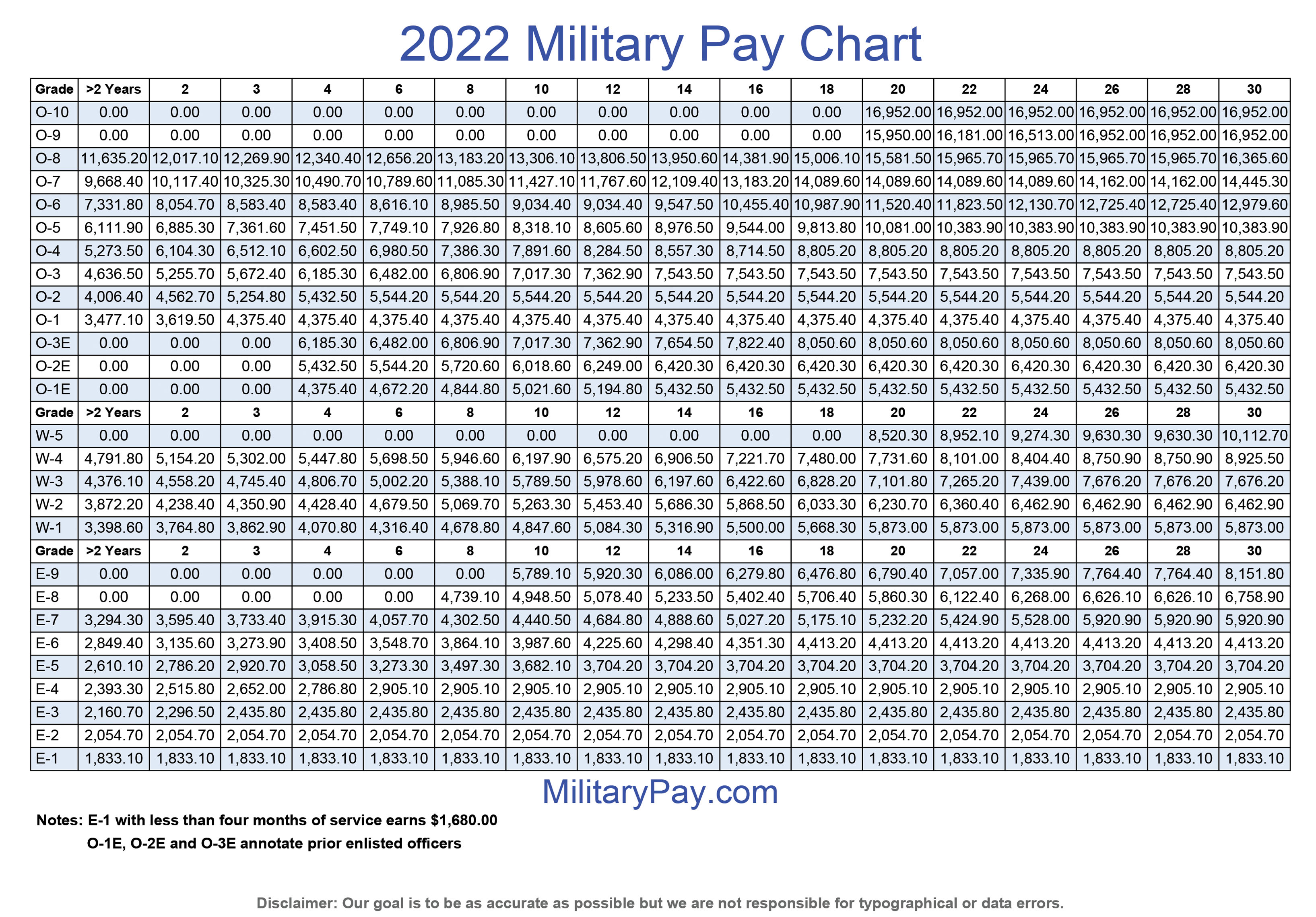

Understanding the Air Force pay scale is crucial for financial planning. This section details the components of Air Force compensation, including base pay, allowances, and bonuses, and how these factors are influenced by rank and years of service. We will also provide comparative examples against civilian salaries.

Air Force Pay Scale Breakdown

The Air Force pay scale is based on rank (E-1 through O-10) and years of service. Base pay increases with both rank and time served. Additional compensation comes from allowances, such as Basic Allowance for Housing (BAH) and Basic Allowance for Subsistence (BAS), which vary by location and rank. Bonuses, such as enlistment bonuses or special duty assignment pay, can significantly boost total compensation.

Impact of Rank and Years of Service

Higher ranks naturally correlate with higher base pay. Similarly, as years of service increase, pay gradually rises, reflecting experience and seniority. This progressive pay structure incentivizes long-term service and professional development.

Example Compensation Packages

A newly enlisted Airman (E-1) might earn a base pay of approximately $20,000 annually, plus BAH and BAS, resulting in a total compensation package nearing $30,000. In contrast, a seasoned Master Sergeant (E-7) with 15 years of service could earn a base pay exceeding $60,000, with allowances potentially bringing the total compensation to well over $80,000. A senior officer, such as a Lieutenant Colonel (O-5), could see total compensation in excess of $150,000 depending on experience and location.

Air Force vs. Civilian Salary Comparison

| Profession | Air Force Rank/Years | Air Force Total Compensation (Estimate) | Civilian Salary (Estimate) |

|---|---|---|---|

| Software Engineer | Captain (O-3) / 8 years | $100,000 – $120,000 | $90,000 – $110,000 |

| Nurse | Captain (O-3) / 10 years | $90,000 – $110,000 | $75,000 – $95,000 |

| Pilot | Major (O-4) / 12 years | $120,000 – $140,000 | $100,000 – $130,000 |

| Mechanic | Staff Sergeant (E-5) / 6 years | $55,000 – $70,000 | $45,000 – $60,000 |

Financial Planning for Air Force Personnel: Your Financial Future The Air Force Nh Pay Scale Made Clear

Serving in the Air Force presents unique financial challenges and opportunities. Effective financial planning is essential for Airmen at all levels to achieve their financial goals. This section Artikels strategies for budgeting, managing finances, and investing while serving.

Common Financial Challenges

Frequent relocations, deployments, and unpredictable schedules can make budgeting difficult. The potential for career interruptions due to deployments or training can impact savings and investment plans. Additionally, managing debt, especially student loans, is a common concern for Air Force members.

Budgeting and Financial Management Strategies

Creating a realistic budget that accounts for variable income and expenses due to deployments or temporary duty assignments (TDY) is crucial. Utilizing military financial resources and tools, such as the Air Force Aid Society, can provide valuable support. Tracking expenses and income meticulously is essential for effective financial management.

Investment Options for Air Force Members

The Thrift Savings Plan (TSP), a retirement savings plan similar to a 401(k), is a cornerstone of Air Force financial planning. Other options include Roth IRAs and mutual funds. Investment choices should align with risk tolerance and long-term financial goals.

Creating a Personalized Financial Plan

- Assess your current financial situation: Track income, expenses, assets, and debts.

- Define your financial goals: Short-term (e.g., emergency fund), mid-term (e.g., down payment on a house), and long-term (e.g., retirement).

- Develop a budget: Allocate funds to meet your goals and track progress regularly.

- Choose investment strategies: Select investments that align with your risk tolerance and time horizon.

- Review and adjust your plan regularly: Life circumstances change; your financial plan should adapt accordingly.

Career Progression and its Financial Implications

Career progression in the Air Force directly impacts financial well-being. This section explores the link between career advancement and salary increases, along with opportunities for professional development and their financial benefits.

Career Progression and Salary Increases

Each promotion to a higher rank comes with a significant increase in base pay and allowances. This structured progression provides a clear path for financial growth within the Air Force.

Professional Development Opportunities

The Air Force invests heavily in professional development, offering various educational and training programs. These opportunities can enhance career prospects and earning potential, both within the Air Force and in the civilian sector after service.

Financial Rewards of Different Career Paths

Different Air Force career fields offer varying compensation packages. Highly specialized roles or those requiring advanced education may command higher pay and benefits. For example, pilots and medical professionals generally earn more than those in other fields.

Resources for Financial Education and Career Planning

- Air Force Aid Society

- Military OneSource

- Thrift Savings Plan (TSP) website

- Financial counselors at Air Force bases

Retirement Planning in the Air Force

Securing a comfortable retirement is a key financial goal for many Air Force members. This section details the Air Force retirement system, including the Thrift Savings Plan (TSP), and provides strategies for maximizing retirement savings.

The Air Force Retirement System

The Air Force retirement system primarily centers around the TSP, a defined-contribution plan offering various investment options. Members contribute a percentage of their pay, and the government often matches a portion of these contributions. Eligibility for a traditional military pension also exists after 20 years of service.

Retirement Plan Options

Air Force members can choose from various TSP investment funds, ranging from low-risk government bonds to higher-risk stock funds. The optimal investment strategy depends on individual risk tolerance and time horizon until retirement.

Maximizing Retirement Savings

Contributing the maximum amount allowed to the TSP is a key strategy for maximizing retirement savings. Taking advantage of government matching contributions further enhances retirement nest eggs. Careful consideration of investment choices and diversification are also crucial.

Calculating Estimated Retirement Income

Source: military-paychart.com

Estimating retirement income involves projecting future TSP balances based on contribution rates, investment returns, and inflation. Online retirement calculators and financial advisors can assist with these projections. For example, a member contributing 10% of their salary for 20 years with an average annual return of 7% could project a significantly larger retirement nest egg than a member contributing 5%.

Securing your financial future with a clear understanding of the Air Force NH pay scale is crucial for long-term stability. Planning ahead often involves considering personal expenses, and maintaining a sharp look is important; finding a great barber is key, so check out this guide to the best barber shops in Pittsburgh if you’re stationed there. Ultimately, careful budgeting and financial planning, alongside personal care, contribute to a well-rounded and successful Air Force career.

Illustrative Examples of Financial Success in the Air Force

These hypothetical scenarios illustrate how Air Force members can achieve financial success through diligent planning and effective strategies.

Scenario 1: The Early Saver

Sarah, an Airman First Class (E-3), started contributing to her TSP aggressively from day one. She lived frugally, prioritized debt reduction, and invested wisely. By her 10th year of service, she had a substantial TSP balance and was well on her way to early retirement. Her income was modest, but her savings and investments significantly outpaced her expenses.

Scenario 2: The Career Focused Investor

Captain John, a pilot, focused on maximizing his income through promotions and additional duties. He carefully managed his expenses and invested a significant portion of his earnings in a diversified portfolio. His higher income allowed for substantial savings and investment growth, setting him up for a comfortable retirement. His disciplined investment strategy outweighed his higher living expenses.

Scenario 3: The Debt-Free Achiever

Master Sergeant Maria, a medical professional, prioritized paying off her student loans quickly after commissioning. She then aggressively saved and invested in her TSP and a Roth IRA. Her disciplined approach to debt management and long-term savings positioned her for financial security. She prioritized eliminating debt early in her career, allowing more funds to go towards savings and investments.

Debt Management and Financial Responsibility

Managing debt and maintaining good credit are crucial aspects of financial responsibility for Air Force personnel. This section provides strategies for debt management and highlights the importance of a good credit score.

Strategies for Managing Debt, Your financial future the air force nh pay scale made clear

Source: militarypay.com

Developing a debt repayment plan that prioritizes high-interest debt is essential. Utilizing debt consolidation options or seeking financial counseling can provide valuable support. Budgeting meticulously to ensure debt payments are consistently met is crucial.

Resources for Financial Hardship

The Air Force Aid Society and other military support organizations offer financial assistance to Air Force members facing hardship. These resources can provide crucial support during challenging financial times.

Importance of a Good Credit Score

A good credit score is vital for securing loans, renting housing, and obtaining favorable interest rates. Maintaining a good credit score benefits Air Force members throughout their careers and beyond.

Potential Financial Pitfalls to Avoid

- Overspending and impulsive purchases.

- Ignoring debt and allowing it to accumulate.

- Failing to plan for unexpected expenses.

- Neglecting to save for retirement.

- Making risky investments without proper research.

Wrap-Up

Planning for your financial future as an Air Force member requires a proactive and informed approach. By understanding the Air Force pay scale, implementing sound financial strategies, and leveraging available resources, you can build a solid foundation for financial security and achieve your long-term financial goals. This guide serves as a roadmap, empowering you to take control of your financial destiny and navigate the unique financial landscape of a military career successfully.